However, when inflationary price increases are stripped out, the picture is very different – citing a -2% decline this year vs 2021.

Highlights from the report include:

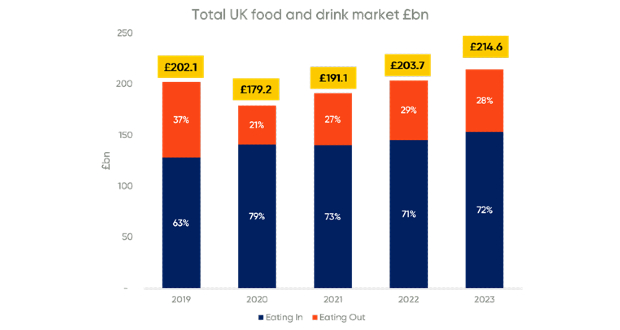

- This year eating in (retail) will account for 71% of the market with eating out (foodservice) at 29%

- This is a recovery for eating out from the 21% share in 2020 but still some way below its pre-pandemic share of 37%

- Retail channels will start to steal share of stomach from foodservice in 2023

- However, retail wins from foodservice will be mostly offset by down-trading by shoppers – cheaper products, buying less and switching to own label

- Growth will be driven by inflation. Real market value is set to decline in 2022 vs 2021

Nicola Knight, insight manager and eating out sector expert at IGD, said: “In 2020 lockdowns forced a strong switch from eating out to eating in, with 2021 showing a gradual return as venues opened and consumer confidence and appetite for going out increased.

However, from Q4 2022 and into 2023 there will be a halt to this trend as retail channels start to steal share of stomach from foodservice, reflecting the challenging economic landscape.”

Retail has already been experiencing the impact of the increased cost of living on shoppers.

In real terms, the UK retail market for food and drink will shrink in 2022 and fall slightly in 2023. Consumers are expected to trade down to cheaper products and switch channels to control their spending.

“Retailers are implementing a variety of initiatives to win and retain shoppers,” said Knight. “These are mainly focused on promoting value and loyalty schemes. This looks set to continue into 2023 as shoppers remain very price sensitive.”

The UK’s eating out market has had a buoyant first half of the year, with 2022 being the first year since the pandemic that operators across all sectors were fully open.

However, even consumers in higher income groups are starting to make changes to spending as fears over increasing energy bills and mortgage repayments start to impact behaviour.

“How the year finishes will depend on how consumers celebrate over the festive season,” added Knight. “Next year the market is likely to see more spend switch to retail and recovery stall in many sectors.”

Talking Retail Grocery and product news for independent retailers

Talking Retail Grocery and product news for independent retailers