Return on Investment, or ROI, is a metric that CPG marketers hear about a lot. However, despite its ubiquity, its definition is often inconsistent or unclear. Let’s demystify the ROI formula, adapt it for the needs of shopper marketers, and discuss practical challenges and approach to ROI measurement in a typical CPG enterprise.

Defining the Shopper Marketing ROI Formula

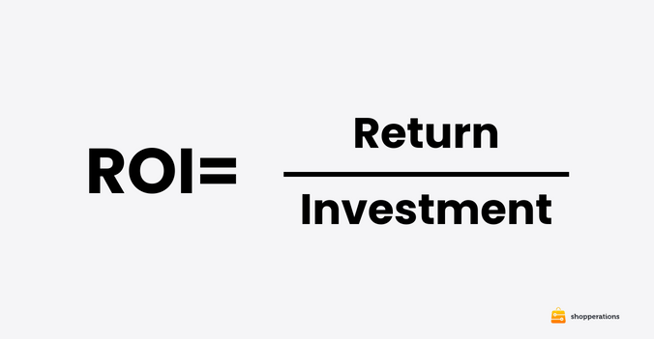

The basic idea behind the ROI formula is to capture the Return in the numerator and the Investment in the denominator. It’s literally, Return “sitting on top” of Investment:

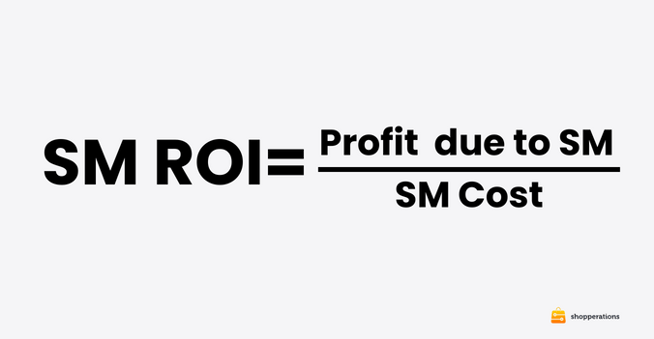

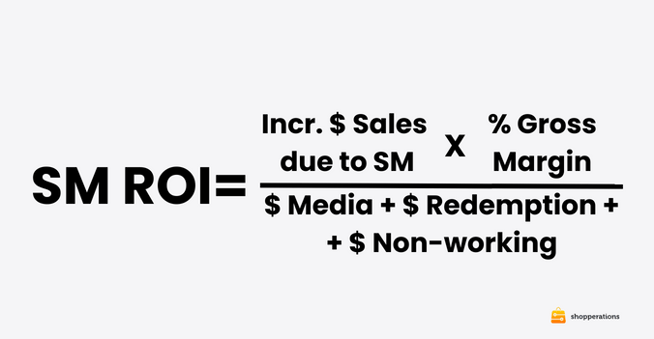

In the case of Shopper marketing, “return” is typically defined as incremental profit delivered due to the executed shopper marketing programs, and “investment” is the cost of shopper marketing programs in question:

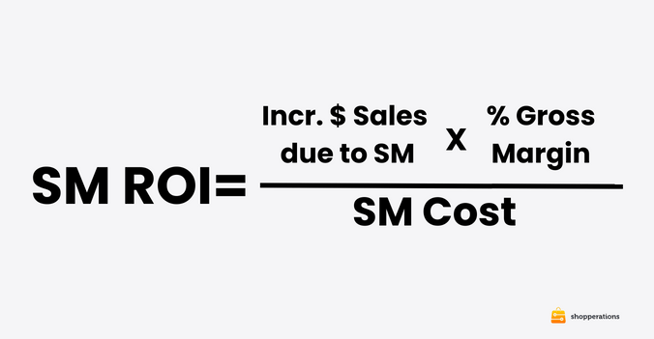

To further decompose the formula and help you calculate the Profit due to SM, you would need to collect two pieces of data: 1) Incremental Sales that typically come from syndicated sales data providers and 2) Gross Margin for participating products, which your finance department can provide. Keep in mind, each product in your portfolio can have a vastly different Gross Margin, so you will need to be able to dynamically calculate it based on participating product mix for each promotion:

SM ROI = (Incr. $ Sales due to SM x %Gross Margin) / SM Cost

Now, let’s look at the denominator. Even though Shopper Marketing Cost is easy to understand in theory, in practice, this relatively straightforward idea is complicated by the fact that in many companies, shopper marketing costs are not consistently tracked because they are fragmented and funded by many different funds, which makes their measurement questionable. For instance, it’s typical to see shopper marketing coupon programs whose variable redemption costs are funded out of a general redemption fund, and actual redemptions may not even be tracked by the managers who create coupon programs. Similarly, trade-funded shopper tactics are often excluded from the analysis, simply because the source fund is owned by a different department. Finally, non-working fees, such as agency retainer, consulting fees, data and software licenses costs that shopper marketing incurs, while not program-specific, must be accounted for in some way to give you an understanding of “fully loaded” SM ROI.

The final formula for Shopper Marketing ROI, therefore, can be expressed as:

SM ROI = (Incr. $ Sales due to SM x %Gross Margin) / ($Media + $Redemption + $Non-Working)

Why Measure Shopper Marketing ROI

ROI measurement is seen as a high priority for most CPG marketing professionals and is one of the most popular KPIs used in the industry. It’s easy to see why:

- Straightforward and Ubiquitous: The idea behind the ROI formula is relatively simple and the metric is known to most business professionals, thus it can be used in conversations with Retailers, internal finance, sales and brand counterparts to find common language and improve collaboration between marketing and sales.

- Unbiased: ROI offers an objective way to compare large numbers of programs and simplify future funding decisions when the budget is limited. I have seen many post-program analyses conducted by the marketers themselves or their agencies. I have also been the one to evaluate my own promotions. Oftentimes, these analyses are built as pretty powerpoints and tend to paint a rather positive picture of the promotion highlighting the best aspects of it. With the quantitative ROI analysis, the story telling is limited, thus it offers an effective way to quickly assess a broad spectrum of programs and focus on the outliers, both successful and unsuccessful in order to affect maximum change.

-

Better suited for shopper marketing than other methods: Other measurement methods may fall short for the needs of shopper marketing. For example, traditional MMA methods are not nuanced enough to capture program-specific sales lift and typically provide only high level guidance on how well shopper marketing performs compared to Trade or National Media. The media metrics, such as impressions, click rates, site visits, etc. are often not tied to buyer conversions, i.e. sales, or do not apply to in-store or traditional print tactics. Whie the media metrics are still important to track, A/B test and optimize, they will not be help you decide what shopper marketing campaigns to repeat and which ones to stop doing altogether.

Limitations of ROI In Shopper Marketing

While measuring shopper maketing ROI is a top priority for most CPG marketing leaders, it has many challenges:

- Claiming Credit for Shopper Marketing Work Is Tricky. Shopper marketing is not an island. Its activities are rarely executed in a vacuum when no national media buys or trade promotions also take place. Because of that, the credit for any sales lift that occurs during the time of your shopper marketing campaign must be “shared” with your colleagues. A typical approach is to develop a regression model that would attribute sales lift to various types of activities. The problem with regression models is at least two-fold: 1) marketers don’t understand them and therefore can’t scrutinize or defend them and 2) they are not sensitive enough to measure event-level impact for shopper marketing campaigns. The workarounds may be:

-

- Measure only stand-alone shopper marketing events that did not coincide with F&D or TPR events, i.e. during non-promoted weeks. This way, you are at least taking out incrementality due to trade spending;

- Implement test v. control methodology into all media buys where a small portion ofthe audience or market is automatically suppressed to measure sales lift for the audience that was exposed to the campaigns. This can be pricey and tedious.

- Expand your ROI framework to measure total incrementality, regardless whether it was driven by trade or shopper activity. This one can actually feel refreshing when you no longer try to “pull the blanket” and claim credit, rather focus on what combination of shopper marketing and trade delivered best results. That is the approach we use at Shopperations, you can learn more here.

- Definition of sales incrementality varies across industry. Nielsen’s and IRI’s base and incremental sales are calculated based on their proprietary models, which not all data scientists in CPG subscribe to. Make sure you understand your company’s stance on the syndicated base volume model before you embark on your analysis.

- Shopper spend is not easy to define. Unlike trade spend that often lives in a TPM system, shopper marketing costs are often planned in spreadsheets and are frequently not tracked with sufficient rigor. Multiple funding sources and ambiguous ownership of some shopper tactics bring another degree of complexity. It may take significant effort to get your post-promotion analytics project off the ground if you don't have a solid planning and actualization capability in place.

- Must have access to Profit data to accurately measure ROI. P&L details are not something that all CPGs are willing to openly share. It’s still very common to treat COGS and Gross Margin information as highly confidential that is shared with a very limited number of people. You may be surprised to learn that many sales and marketing teams in CPG are still incentivized on topline growth and have no idea about true profitability of their activities.

- Short-term nature of ROI metric. ROI doesn’t take into account top of the funnel impact and long-term base growth. Demos and sampling traditionally have terrible ROIs due to high cost and short duration. However, if building awareness and trial is your goal, low short term ROI should not be your main KPI.

Start Small

If you are planning to implement a new ROI measurement discipline on your team, don’t try to “boil the ocean”. Understanding the above limitations of ROI measurement in shopper marketing, start small and make frequent adjustments as you gradually build your approach to post-program measurement:

- Decide what version of the ROI formula you will use. The simpler the formula you use and the more accepted it is across the organization, the better. Solicit feedback from your team and see if the formula you choose is easy for them to understand and explain to others.

- Define the measurement threshold. Not every single program deserves to be measured, perhaps you can set a cut off of $50K as a minimum program cost for ROI measurement. If you have too many programs under that threshold, ask yourself why you are spreading your funds so thin?

- Determine which programs and tactics can be exempt from ROI scrutiny. For example, in-store demos and sampling, expensive aisle reinvention initiatives and high value new product trial coupon offers will likely show pretty bad short term ROI. Consider alternative KPIs for programs such as these.

- Commit to accurately capturing spend data that feeds the ROI denominator. All the programs that you define to be within scope must have accurate actual spend data collected. The more automated this process, the less likely you will have human errors. Tracking expenses by Brand/Product, retail customer, as well as accurately capturing in-market dates (that can be different from accrual or payment dates!) is something you need to commit to for sustainable post-promo analysis.

With the above tasks checked off, you will be in a great position to start the actual modeling and analysis. At this stage, you will likely need help from data scientists who can connect your marketing expenses data with the sales data to enable automatic reporting and visualization. You will need either a dedicated analyst for your team (lucky you if you have them!), an internal shared resource or an external analytics partner to do the work.

Shopperations’ clients have a great advantage: their post-promo analytics process can be quickly automated because our software saves time when collecting data for any existing or future analytics projects. We also offer an easy-to-use post-promotional analytics dashboard, which combines investment data from Shopperations with syndicated sales data to offer a quick read of how well your programs performed.

To learn more about our post-promo services and schedule a free demo visit our new site.

Other Posts You May Like:

Cart Before Horse: YOu are Not Ready for Marketing Analytics

5 REASONS TO SHAKE UP YOUR SHOPPER MARKETING OPERATIONS, NOW

9 STEPS TO GUIDED DECENTRALIZATION OF SHOPPER MARKETING