Inventory is a funny thing for retailers. It’s so often one of the biggest costs, while also being the primary source of business income. That’s why knowing your gross profit margin is key to retail business growth, but so is the inventory costing method your accountants use.

The delicate balance between assets and costs is why it can be helpful to review how to track, understand and improve inventory costing on your books. Are you currently using the best method for your business, or could your books do with an overhaul?

In this article, we’ll take you through ways to value your inventory:

- What is inventory costing?

- How to choose an inventory costing method

- The retail inventory method

- The specific identification method

- The First In, First Out (FIFO) method

- The Last In, First Out (LIFO) method

- The weighted average method

- Niche inventory costing methods

- Challenges in inventory costing

Retail Math Made Simple

31 formulas that’ll help you make better decisions.

What is inventory costing?

Getting an accurate picture of your business’ inventory can be a challenge, but it’s important to do so. You need to know how much inventory you have in your business at different times, as well as product-level data about what is selling and what is stalling.

Similarly, it pays to know how much stock is being sold or lost each day, month and year through frequent cycle counting and accurate inventory management records. Having too much or too little inventory, along with discounting, can hit your bottom line if you aren’t careful.

That’s where inventory costing (also known as inventory valuation) comes in. Inventory costing gives your business an accurate picture of what is likely your largest asset, which is crucial for informed financial decisions.

What are inventoriable costs?

Inventoriable costs are all expenses directly tied to acquiring products and preparing them for sale.

These typically encompass the purchase price of the goods, shipping fees and any direct labor or materials required to bring the merchandise to a sellable state. Handling and storage costs may also be included if they are essential to make the goods ready for sale.

Inventoriable costs are critical for managing stock as they directly impact the valuation of inventory on the balance sheet and affect the cost of goods sold on the income statement. For products, these costs ensure that the pricing strategy covers the actual expenses incurred, supporting profitability.

Costs that are not directly linked to product acquisition or preparation are not considered inventoriable. This includes overhead expenses such as marketing, administrative salaries and general office expenses. These are instead treated as period costs and are expensed in the period they are incurred.

COGS vs cost of inventory

Obviously, both cost of goods sold (COGS) and cost of inventory are important metrics, and they have some overlap, but they’re separate data points for a reason.

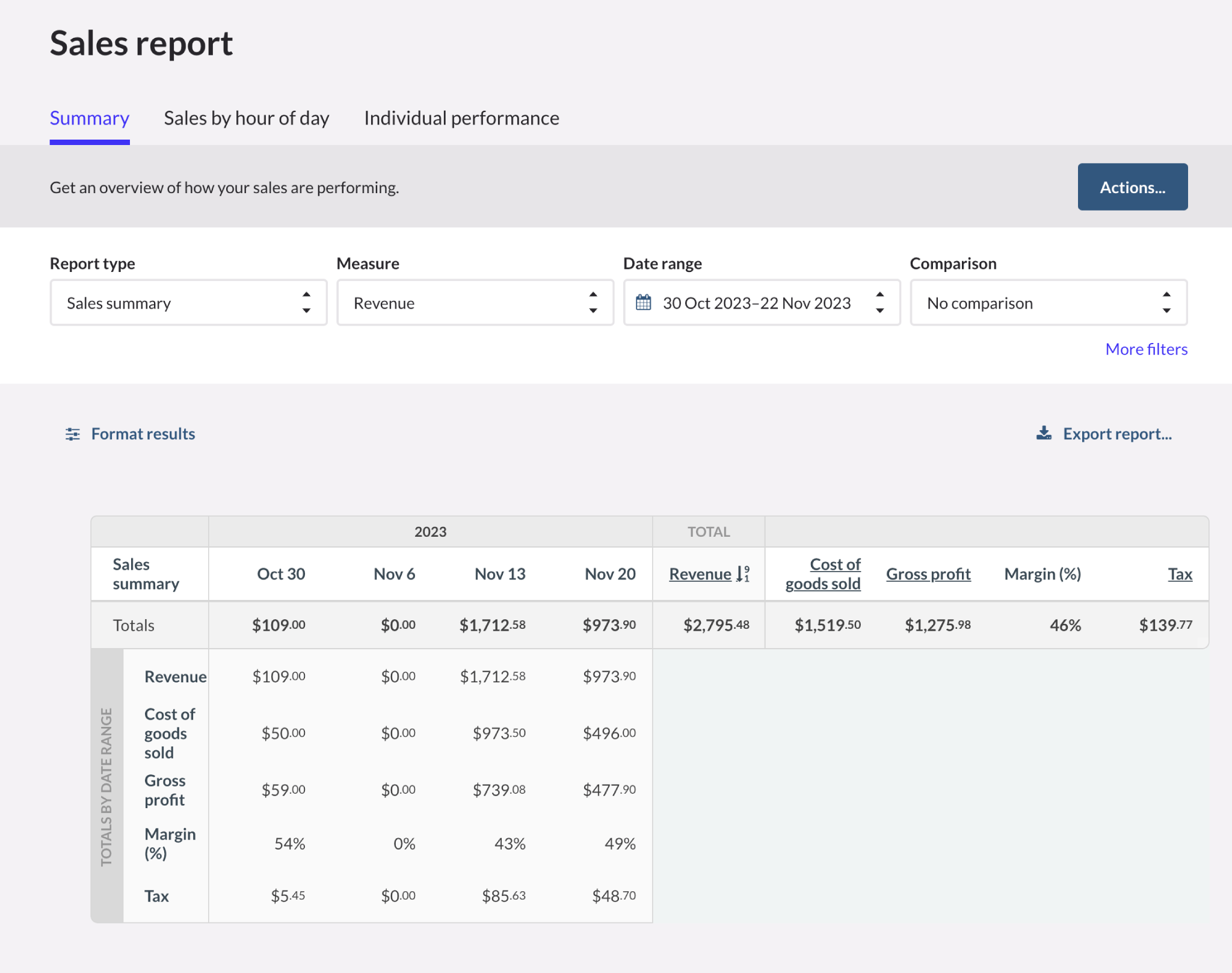

Your COGS is just that—the cost of all goods sold across every location and channel. In an accounting context, your inventory is an asset. You can find it by running reports in your accounting or POS system, like through Lightspeed’s sales reporting.

Inventory costing tracks how much that asset cost your business. COGS tracks changes in inventory. Your inventory cost can be, and often is, higher than your COGS, because of one unfortunate reality: not all inventory sells.

How to choose an inventory costing method

Because every business manages inventory differently, there are multiple ways to measure inventory. To ensure your business is using the right method for inventory costing, ask yourself:

- Where are you currently doing business? Where do you plan to do business in the future? Some methods, like last in first out, can’t be used outside of the United States.

- How big is your inventory? Methods like specific identification will get unwieldy with larger inventories.

- Are you selling goods that expire, like medicine? You’ll want to choose a method that accounts for selling sooner-to-expire products first.

- How often do the sourcing costs of your inventory fluctuate? If costs are rarely fixed, a method like weighted average won’t work for you.

Tax ramifications of inventory costing

It’s worth asking your accountant or tax agent about what each method means for your business and its tax obligations.

As a retailer, you can track the costs of inventory purchases throughout the year. But you are not allowed to deduct the cost of inventory on hand at the end of the year. The cost of inventory on hand must be included on your ending balance sheet as an asset and deducted in the following year when your inventory is sold.

Legal and regulatory considerations in inventory costing

Globally, businesses must align their inventory accounting methods with the International Financial Reporting Standards (IFRS) or, in the United States, the Generally Accepted Accounting Principles (GAAP).

The IFRS and GAAP have distinct rules and regulations. One notable distinction is the prohibition of the Last-In, First-Out (LIFO) method under IFRS, which is still permissible in the United States. This difference can affect a company’s financial reporting and tax obligations depending on the jurisdiction.

Local tax laws also influence the choice of inventory costing method. For example, using LIFO can lead to different tax outcomes compared to the First-In, First-Out (FIFO) or average cost method, potentially impacting a company’s taxable income and tax liability. Businesses must stay informed about these legal requirements to ensure compliance and optimize their tax positions.

With these potential complexities in mind, make sure you consult with financial professionals to ensure your inventory costing methods meet legal standards applicable to your business.

Common retail inventory costing methods

| Method | Description | Pros | Cons |

| Retail Inventory Method | Measures cost of inventory relative to the price of goods, assumes consistent markup. | Easy to calculate, works with weak cost tracking. | Not very accurate, especially with fluctuating prices and different markups. |

| Specific Identification | Assigns a specific cost to each item, suitable for varied and unique items. | Accurate profit and loss statements, good for small businesses with unique items. | Becomes unwieldy with larger inventories, requires detailed tracking. |

| First In, First Out (FIFO) | Assumes sales are from the oldest inventory batch, suitable for nearly identical items with fluctuating prices. | Accurate representation of inventory, good for financial analysis. | More effort to track costs within the same SKU for different batches. |

| Last In, First Out (LIFO) | Treats the last items bought as the first sold, opposite of FIFO. | Helps reduce tax liabilities in rising price environments. | Complex record-keeping, only usable in the US, not very common in retail. |

| Weighted Average Method | Uses a pool of cost for all units of a particular SKU, blending all purchases together. | Easier to track than specific costing, especially useful for many identical units. | Less accurate than specific costing if purchasing at very different prices. |

1. The retail inventory costing method explained

The retail method provides the ending inventory balance for stores by measuring the cost of inventory relative to the price of the goods. In essence, it determines how much expense to recognize this period versus the next period.

The retail method assumes that all your inventory has a consistent markup, explains Abir Syed (CPA) of UpCounting. “So you take the total value of what you have for sale, reduce it by its markup, and use that number as your cost.”

The pros and cons of the retail method

The benefit of this method for inventory costing, explains Abir, is that it’s extremely easy to calculate and can work when you have weak inventory cost tracking. “The main con is that it’s generally not very accurate, especially if you have prices that fluctuate at different times of the year (which most retailers do), and if you have products with different markups.”

FitSmallBusiness tax and accounting analyst Tim Yoder says the retail inventory method works best if you have a standard markup, within broad product lines. “If your markups vary widely among products, then your estimate won’t be very accurate,” says Tim.

Retail inventory method formula

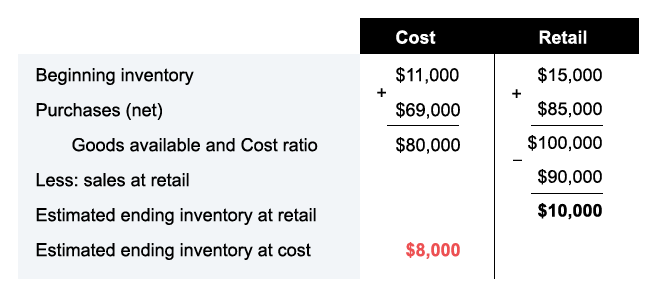

Here is the retail method formula, courtesy of AccountingCoach.

Example of the retail inventory method

As AccountingCoach explains in the above example, the cost of goods available of $80,000 is divided by the retail amount of goods available ($100,000). This results in a cost-to-retail ratio (or cost ratio) of 80%. To get the estimated ending inventory at cost, you multiply the estimated ending inventory at retail ($10,000) times the cost ratio of 80% to arrive at $8,000.

2. The specific identification method explained

This is when you assign a specific cost to each and every item in your stores. Abir says this method makes the most sense for retailers that have a lot of different items, especially if they were bought from various sources. “A good example would be an antique dealer,” says Abir.

The pros and cons of the specific identification method

The pros and cons of the specific identification method depend on the size of your retail business, according to the Corporate Finance Institute (CFI). For the specific identification method to suit your retail business, you need to be able to confidently and accurately identify the location, cost, and sale amount of every stock-keeping unit (SKU) in your inventory. The bigger your business and its inventory, the harder that becomes.

The CFI suggests specific identification is better suited to small businesses because it can give them a more accurate profit and loss statement, with reliable numbers on income and losses and normal spoilage of inventory (due to things like accidental damage).

Specific identification method formula

Here is a simplified specific identification method formula, based on the following values:

- (A) Purchase quantity = 3,000

- (B) Units sold = 1,000

- (C) Balance = 2,000 (C = A – B)

- (D) Price = $5.00

- Closing inventory = $10,000 (C x D)

- Cost of Goods Sold = $5,000 (B x D)

Example of the specific identification method

“Let’s say someone sells unique paintings that they buy from local artists and then sells,” says Abir.

“This person has one painting in stock worth $150. They then buy three paintings for $100, $200, and $350. So their total cost of inventory is the sum of all the individual costs ($150 + $100 + $200 + $350 = $800).”

“If they then sell the $200 painting, their cost of inventory would be $800 – $200 = $600. Each item’s cost is tracked separately.”

3. The First In, First Out (FIFO) method

When your business has large numbers of nearly identical items, specific identification may not be worth the effort. First In, First Out, or FIFO, might be better. FIFO assumes that any sale of an item is from the oldest batch on hand, and is relevant when the prices you bought it at fluctuate.

The pros and cons of the FIFO method: does the FIFO method help retailers?

The FIFO method can help retailers financially by ensuring that the cost of inventory recorded on the balance sheet reflects the most recent prices, which can be advantageous in times of rising prices.

“This method will give you a very accurate representation of your inventory, which can be beneficial if you buy batches of the same item at varying prices,” says Abir. “It will often mirror reality as older units of a stock-keeping unit (that scannable barcode) tend to be sold before the newer ones in ideal circumstances.

This can result in lower cost of goods sold and higher reported profits. Additionally, FIFO can lead to a more accurate match of current market conditions in financial reporting, potentially improving financial analysis and decision-making.

“The downside is that it takes more effort to track different costs within the same stock-keeping unit for different batches of purchases. For example, if you sell a particular shirt with one universal product code (UPC) that was bought in three batches, it’s harder to track a different cost for each batch than one cost for the entire UPC.”

FIFO method formula

As Freshbooks explains, you can calculate FIFO by multiplying the cost of your oldest inventory by the amount of that inventory sold.

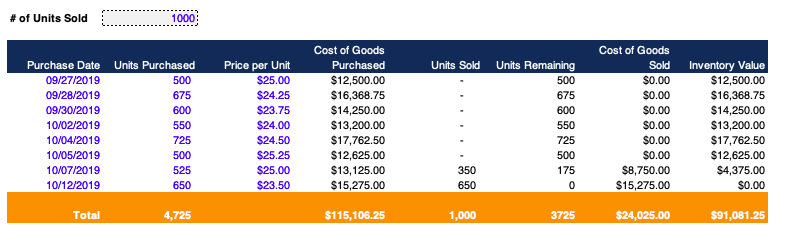

Example of the FIFO method

“Let’s say someone sells leather jackets,” says Abir. “They buy 10 for $100 each, and then later 10 more for $90 each. The total value of the inventory will be ($100 x 10) + ($90 x 10) = $1,900.

Even if all jackets were identical and sitting on the same rack, if they were to sell three jackets, they would calculate the Cost of Goods Sold (COGS) by deducting it from the older batch purchased at $100/each—regardless of which batch they were actually sold from.”

He adds: “So their ending inventory cost would be $1,900 minus (3 x $100) = $1,600. The logic here is that the more accurate inventory cost would be the more recent purchase price, as that’s the price you’re more likely to buy more inventory at.”

4. The Last In, First Out (LIFO) method

LIFO, as the name suggests, is basically the opposite of FIFO. It treats the last items bought as the first ones sold. Here’s what Abir has to say about this method.

“LIFO is when you attribute specific costs to individual items or batches of items based on their actual cost, and you reduce your cost as you sell items with the last items added being removed from inventory first. This method only makes sense when it actually mirrors reality where the newest items are sold first, and older items can sit there for a long time.”

It’s not a particularly common method, he explains, because this rarely happens in retail.

The pros and cons of the LIFO method: does LIFO help with taxes?

LIFO is definitely not for every retailer. In fact, it can only be used in the United States under the Generally Accepted Accounting Principles (GAAP). Elsewhere, this method is not allowed by the International Financial Reporting Standards (IFRS). It can create an added burden around record-keeping. For many businesses, it’s a system that is just too complex to justify using.

That said, one of the main benefits is tax. Because LIFO results in a higher Costs of Goods Sold (COGS), the method may help rein in tax liabilities. By accounting for the most recently acquired inventory first, LIFO typically results in higher cost of goods sold and lower reported profits in such scenarios. This can lead to reduced taxable income, thereby potentially lowering a company’s tax liability in the short term, which can be financially beneficial for businesses during periods of inflation.

Still, it’s always important to check the exact impacts of LIFO with your accountant or tax advisor.

LIFO method formula

Investopedia has the following helpful LIFO example, of a furniture store that buys 200 chairs for $10 per unit. Next month the store buys another 300 chairs for $20 each, and at the end of their accounting period, it has sold 100 total chairs.

Cost of goods sold = 100 chairs sold x $20 = $2,000

Remaining inventory = (200 chairs x $10) + (200 chairs x $20) = $6,000

Example of the LIFO method

Here’s a more detailed LIFO example, from the Corporate Finance Institute.

5. The weighted average method

If the prices of the products your business buys hardly change, then your accountant can use an even easier method called Weighted Average Costing.

With the weighted average method, you use a pool of cost for all units of a particular stock keeping unit. Any purchase is added to the pool of cost, and the pool of cost is divided by all units you have on hand.

The pros and cons of the weighted average method

“The benefit is that it’s much easier to track than specific costing because you don’t need to know exactly which batch a sold unit was part of, which is especially helpful when you have many identical units,” says Abir. It may also give you a more accurate costing method than the retail method—which doesn’t compensate for discounts or differing margins across SKUs.

What is the downside? This method can be less accurate than specific costing because you’re blending all your purchases together, says Abir. “But this is only a real problem if you buy a particular stock-keeping unit at very different prices each time you purchase, which is often not the case.”

Weighted average method formula

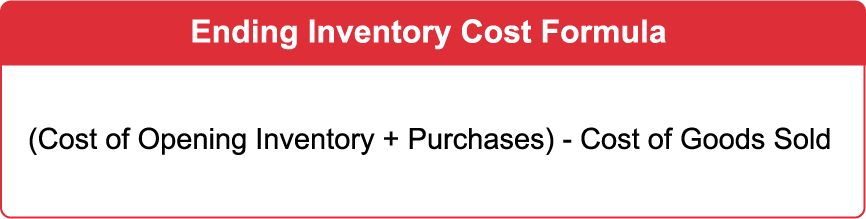

For this method your inventory cost at the end of a period is calculated as follows:

Your unit cost is simply the total cost for a given product, divided by the total number of units you have.

Example of the weighted average method

Let’s hear an example from Abir again.

“If we used this method for our leather jacket example from the above [FIFO section], after you purchase both batches of jackets, your total cost of inventory will still be $1,900,” he says.

“The difference is that instead of having 10 jackets worth $100 each and 10 worth $90 each, you’ll have 20 jackets worth $95 ($1,900 / 20) each. And so if you sold three jackets, you wouldn’t sell $300 worth, you’d sell $95 * 3 = $285. So your ending inventory balance would be $1,900 – $285 = $1,615.”

Niche inventory costing methods

These are much rarer ways of tracking inventory costs.

| Method | Description | Pros | Cons |

| Highest In, First Out (HIFO) | The highest costing inventory is the first to be taken out of stock. | Could help reduce taxable income or asset value for a limited time. | Very rare, not recognized by GAAP or IFRS, may lead to scrutiny. |

| Lowest In, First Out | Assumes the lowest costing inventory is sold first. | Accepted under GAAP in the US. | Not officially recognized internationally, can lead to higher than normal inventory valuation. |

| First Expired, First Out | Inventory that will expire sooner is sold first, important for avoiding wastage. | Essential for businesses with expiring inventory like grocery stores or pharmacies. | Limited use for retailers without expiring inventory, niche method. |

6. Highest In, First Out

In Highest In, First Out (HIFO), the highest costing inventory is the first to be taken out of stock. While not a way of inventory costing companies would use as their primary method, it could help a company reduce its taxable income or asset value for a limited time.

HIFO is very rare, and not recognized by GAAP or the IFRS. As such, your business may come under scrutiny if you use this method.

7. Lowest In, First Out

Lowest In, First Out (LIFO) is the opposite of HIFO. The lowest costing inventory is assumed to be sold first.

LIFO is not an officially recognized inventory costing method internationally because it can lead to a higher than normal inventory valuation—and is thus heavily scrutinized. However, it is an accepted method in the United States under GAAP.

8. First Expired, First Out

Under First Expired, First Out (FEFO), inventory that will expire sooner is sold first. This is an important method for businesses looking to avoid wastage, such as grocery stores or pharmacies.

While FEFO is important for medicine—and, in fact, recommended by guidelines from the EU—it has little use for retailers without expiring inventory, making it a niche accounting method.

Challenges in inventory costing to watch out for

Here are common challenges you might face when implementing inventory costing methods.

Discrepancies between physical stock counts and accounting records

When physical inventory does not align with recorded inventory, it complicates financial reporting and can lead to inaccurate cost of goods sold calculations and inventory valuations.

Mismatches can arise from:

- Theft

- Damage

- Lack of familiarity with a new inventory costing method

- Other clerical errors

- Mismanagement of stock

These inaccuracies affect profitability measures and tax calculations, potentially leading to financial discrepancies that may raise red flags during audits. Misreported inventory levels can also distort a retailer’s understanding of their stock turnover ratio, leading to poor purchasing decisions and overstocking or understocking situations, which in turn can impact sales and customer satisfaction.

Tracking costs across multiple channels

Each sales channel may involve different costs due to variations in handling, shipping and storage requirements.

The difficulties are compounded when trying to maintain uniform pricing across channels while accounting for these varying costs. For instance, online sales might incur additional shipping and handling fees, which do not apply in physical stores. Similarly, promotional activities exclusive to one channel can disrupt standard cost calculations, affecting overall profitability analysis.

Furthermore, the integration of data from diverse systems can lead to discrepancies in cost tracking and inventory management. Retailers managing inventory costing often struggle with reconciling these differences, leading to potential inaccuracies in financial reporting and decision-making.

How can you make inventory costing easier?

To overcome these challenges, invest in advanced inventory management system that can integrate data seamlessly across all platforms. This enables a holistic view of inventory costs and movements, ensuring accurate costing and financial reporting.

Addressing discrepancies requires robust inventory management systems and regular stock audits. Accurate tracking and reconciliation of physical stock to the accounting records is essential to maintain financial integrity and operational efficiency. Make sure you’re using tools, like Lightspeed Scanner, to make stock audits and reconciliation as easy and accurate as possible.

“Before the scanner app, we would have several staff members work on counting inventory and we would input the inventory into a spreadsheet so that we could input it into the one terminal where we could all contribute to the count, which was accurate but inefficient. And it took a long time and a lot of effort and a lot of pain. So now with Scanner, it really helps many employees work on the inventory at one time together and bust through it really quick and make it pretty snappy and almost fun. “

Andy Linn, Co-Founder, City Bird

Retail accounting: Inventory management is key

No matter how well you’ve vetted your business’ inventory costing method, and no matter how expert your accountants are, if your inventory management is a mess, you’re going to have trouble tracking costs accurately.

A commerce platform like Lightspeed streamlines management of even the most complex inventory. By equipping your teams in your stores with intuitive technology they can use to track, sell, receive and manage inventory without errors, you get cleaner data for your logistics teams to act on.

And that’s just the beginning. Why not watch a demo and see for yourself?

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.